Corporate Governance

Basic approach

The DeNA Group mission is “We delight people beyond their wildest dreams.” Included in this mission is the goal of the Group to bring delight and joy to each and every customer, beyond their imagination, and create a world where people’s individuality can shine.

The DeNA Group will embody its mission through appropriate dialogue and cooperation with a variety of stakeholders including customers, partners, employees, shareholders, and regional society. The DeNA Group will continue to establish and enhance effective corporate governance and aim to continuously maximize its corporate value.

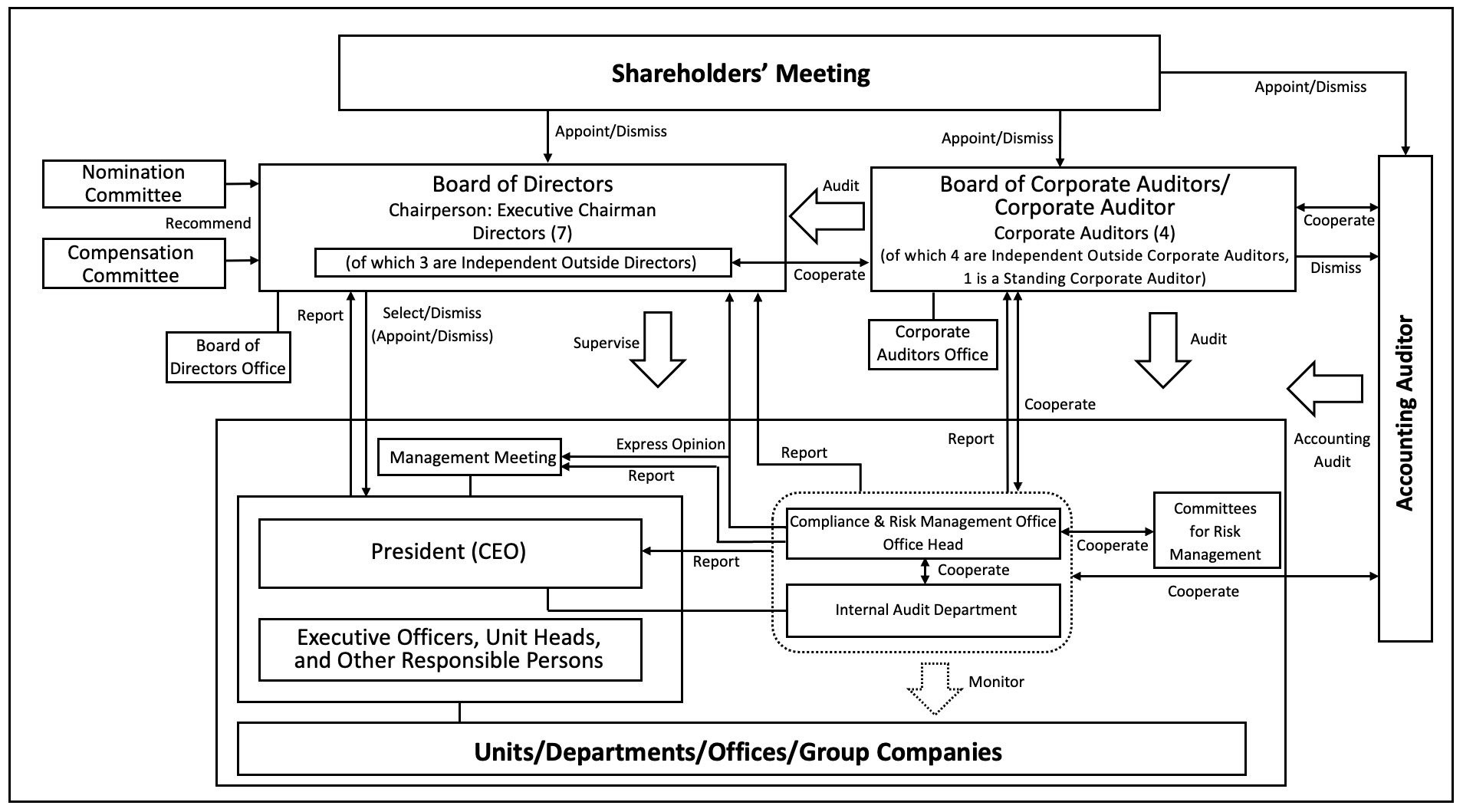

Structure

Structure for Corporate Governance (Diagram)

The following is an excerpt from the Corporate Governance Report dated February 20, 2026. Please see here

(https://dena.com/intl/ir/library/report.html) for more information.

1. Board of Directors

The Board of Directors is composed of six (6) directors, three (3) of whom are independent directors. In addition to regular monthly Board meetings, the Board convenes extraordinary meetings when necessary.

The Board of Directors makes important management decisions and performs an oversight function for overall business execution under the executive officer system, which is centered on the President & CEO.

The Chairperson for the Board Meetings will be selected at the meeting of the Board of Directors every fiscal year, and will be the director in the Board of Directors most appropriate to serve an oversight function. The Chairperson for the Board Meetings will officiate the approval and denial of agenda items and the setting of the agenda, including deliberation and resolution items for the Board of Directors, and reports on business execution. As of June 2025, the Chairperson for the Board Meetings is the Representative Director & Executive Chairman Tomoko Namba.

The term for directors is one (1) year.

The Board of Directors has delegated decision-making authority on specific business execution issues to executive officers, unit heads, and other responsible persons. By doing so, the Company aims to enhance oversight of business execution, as well as place greater focus on management strategy, etc. discussions from a mid to long-term perspective as well as a big picture perspective. Also, the Company analyses and evaluates the effectiveness of the Board of Directors as a whole, engages in discussion to further enhance the effectiveness of the Board of Directors, and engages in other initiatives to strengthen the functions of the Board of Directors.

The Company has established the Board of Directors Office as a department to support the operations of the Board of Directors.

Information regarding the composition of the Board of Directors may be found in the Securities Report on the Company’s website. Information regarding the number of Board meetings held and the attendance rates of each director for fiscal year 2024 may be found in the Notice of the Convocation of the 27th Ordinary General Meeting of Shareholders on the Company’s website.

[Nomination Committee and Compensation Committee]

The Company has established a Nomination Committee and a Compensation Committee, which are voluntary bodies. This is in order to ensure transparency and objectivity as well as with the objective of ensuring accountability, including the appropriate participation of and advice from outside directors, in matters regarding personnel selection and compensation, which are key factors for the Board of Directors to fulfill its oversight function.

Both committees are made up of a majority of independent outside directors (75% ratio as of the date of this Report), who fulfill the Tokyo Stock Exchange requirements for independent director in addition to the standard* separately established by the Company. The chairman is also chosen from among the independent outside directors, to enhance independence and objectivity. An executive director also serves as a committee member so that the business execution viewpoint is considered for substantive discussion on personnel selection and compensation.

*For more details about the standard, refer to “I. Basic Approach to Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information, 1. Basic Approach, [Disclosure Based on Principles of Corporate Governance Code], (Principle 4.9) Independence Standards and Qualification for Independent Directors” of this Report.

The Nomination Committee is providing recommendations regarding the initial proposals and basic approach to nomination policy for directors, corporate auditors, and executive officers, and providing recommendations on advice regarding initial proposals for the succession plan and the approach for training management and executive officer candidates. For these recommendations on proposals related to nomination and dismissal, etc. the independent outside director committee members meet with candidates to select an individual with an excellent diversity of insight and who has the skills* required to realize the Group mission, vision, and value, regardless of individual candidate characteristics such as gender or age, etc., and the Board of Directors duly consider the recommendations before making resolutions regarding nomination.

As of June 2025, the chairman of the Nomination Committee is the independent outside director Haruo Miyagi. The remaining committee members are the independent outside directors Masaya Kubota and Tetsuo Kitan, and the Representative Director & Executive Chairman Tomoko Namba. The Nomination Committee under its previous membership met ten (10) times in fiscal year 2024. The previous committee members attended 100% of meetings.

*For more details about the skills the Board of Directors and individual directors should possess, other skills valuable for achieving the Group mission, vision, and value, and business plan, and the particular strengths of each director, refer to the disclosure in “I. Basic Approach to Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information, 1. Basic Approach, [Disclosure Based on Principles of Corporate Governance Code], (Principle 4.11.1) Balance between Knowledge, Experience and Skills of the Board of Directors; Diversity and Appropriate Board Size” in this Report.

The Compensation Committee is providing recommendations regarding initial proposals for the compensation structure for directors and individual allocation, as well as the compensation structure, incentive plans, and evaluation criteria for executive officers, and the Board of Directors duly considers the recommendations before making resolutions regarding compensation.

As of June 2025, the chairman of the Compensation Committee is the independent outside director Masaya Kubota. The remaining committee members are the independent outside directors Haruo Miyagi and Tetsuo Kitani, and the Representative Director & Executive Chairman Tomoko Namba. The Compensation Committee under its previous membership met six (6) times in fiscal year 2024. The remaining committee members attended 100% of meetings.

2. Delegation of Authority

The Company is proceeding with delegating authority to unit heads and other responsible persons in order to clarify roles and responsibilities for oversight and execution, and with the aim to enhance the oversight function of the Board of Directors while also improving the efficiency of business execution.

Each responsible person is responsible for business execution related to proposing and carrying out strategy and plans for each business or functional area.

The representative directors shall be responsible for and oversee the business execution by these responsible persons.

3. Management Meeting

The management meeting in principle is held weekly and is made up of the executive directors who were selected as executive officers, managing executive officers, and designated by the president. The management meeting’s chairman is a constituent member determined beforehand in the management meeting, and the management meeting makes decisions regarding important business execution matters. Also, in order to ensure consistency and improve efficiency in execution approach, reports and deliberations about each area shall be conducted by the respective responsible person.

Further, resolutions of the management meeting are approved by a majority vote of the constituent members present (at least one for vote must be from a constituent member who is not a representative director), in order to better ensure the effectiveness of governance for decision-making in important business execution matters.

As of June 2025, the chairman of the management meeting will be the Representative Director, President & Chief Executive Officer (CEO) Shingo Okamura. The management meeting is made up of five members, consisting of Representative Director, President & Chief Executive Officer (CEO) Shingo Okamura, Director, Executive Officer, & Head of the Corporate Unit Keigo Watanabe and three other individuals designated by the President.

4. Corporate Auditors / Board of Corporate Auditors

The Company has four (4) corporate auditors, three (3) of whom are independent outside corporate auditors. One of the outside corporate auditors have extensive experience in finance and accounting at a business corporation, one worked on audit operations among others primarily for financial institutions for many years, and the last has many years of experience working in finance and accounting in a financial institution, and each has considerable expertise in finance and accounting.

Each corporate auditor attends meetings of the Board of Directors and the management meetings, interviews officers and employees, reviews materials relating to important decisions and authorizations and broadly monitors the management of the Company in general. Each corporate auditor conducts appropriate monitoring of management from an independent standpoint while also sharing information with the other corporate auditors at meetings of the Board of Corporate Auditors, and strives to perform his/her audit duties efficiently and with a high degree of effectiveness.

The Company has established the Corporate Auditors Office to support the duties of the corporate auditors. This Office has dedicated staff with authority to conduct appropriate investigations and gather information.

5. Internal Audit

The internal audit department conducts internal audit of the Company. Based on the Company’s rules for internal audit and an internal audit plan approved by the Board of Directors, the internal audit department conducts audits of each relevant department or division (including material subsidiaries of the Company).

The internal audit department reports directly on the results of each audit to the Company’s representative directors, the Board of Directors, and the Board of Corporate Auditors. The department/division subject to such audit also receives notice of the results of such audit and thereafter, the internal audit department follows up on improvements made based on recommendations from such audit.

6. Accounting Auditor

The Company has engaged Ernst & Young ShinNihon LLC as its accounting auditor. In fiscal year 2024, two (2) certified public accountants of Shin Nihon had overall responsibility for the Company’s audit and they were supported by 38 assistants (8 certified public accountants, and 30 others). Further, the certified public accountants who conduct the Company’s audit are changed regularly in compliance with the Certified Public Accountants Act.

7. Limited Liability Contracts

In order to recruit valuable directors (excluding inside directors, etc.) and corporate auditors and enable them to adequately perform their expected duties, the Company has, on the basis of Article 26(2) and Article 34(2) of the Articles of Incorporation, concluded contracts with each director (excluding inside directors, etc.) and each corporate auditor to limit liability for damages under Article 423(1) of the Companies Act. The maximum limit of liability for damages on the basis of said contracts for both directors (excluding inside directors, etc.) and corporate auditors is 10 million yen or the minimum amount stipulated in Article 425(1) in the Companies Act, whichever is higher.